Studies have disclosed that crypto entrepreneur and Tron founder Justin Solar moved a large quantity of Ethereum right into a liquid-staking service this week.

In accordance with on-chain information, about 45,000 ETH — price roughly $154.5 million on the time — was shifted from the lending protocol Aave into the Lido Finance staking pool.

The switch was public and traceable on the blockchain. It drew fast consideration due to its scale and timing.

Solar’s Public Wallets Develop

The funds had been sitting on Aave earlier than the transfer. They had been then deposited into Lido, which points staked-ETH tokens that allow holders hold a type of liquidity whereas their ETH is staked.

Primarily based on experiences, Solar’s public wallets now present round $534 million in ETH holdings. That determine has reportedly surpassed his holdings in TRON’s native token, TRX, that are estimated close to $519 million.

Market watchers say the swap indicators a shift in how some massive holders are allocating capital.

JUSTIN SUN JUST STAKED OVER $150M OF ETH [ARKHAM INSIGHTS]

Justin Solar simply withdrew $154.5M of ETH (45,000 ETH) from AAVE and deposited it to Lido Staking. He at present holds $534M of ETH in his public wallets, much more than he holds in TRX ($519M).

We discovered this by means of… pic.twitter.com/rwU3H5uIKu

— Arkham (@arkham) November 5, 2025

Larger Stakes, Larger Questions

Analysts reacted quick. Some see the motion as a vote of confidence in ETH’s yield choices and protocol safety. Others raised the purpose that enormous sums routed into single liquid-staking suppliers can add to centralization dangers on the community.

Worth stays unpredictable. Additionally, staking carries its personal dangers — sensible contract bugs, validator downtime, and slashing occasions are potentialities that traders should weigh.

Market Context And Worth Motion

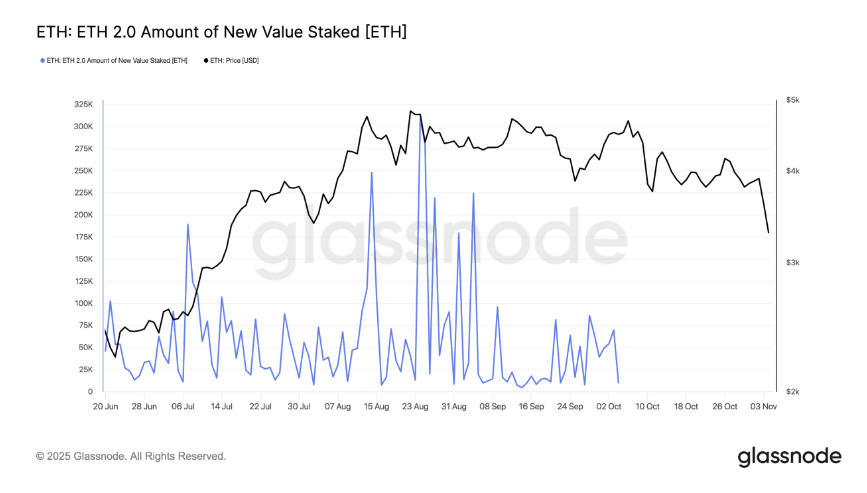

Primarily based on experiences, ETH was buying and selling close to $3,389 when this motion was famous. The token had slipped about 12% within the earlier week, which makes massive staking flows extra seen as a result of giant buys or inner transfers stand out towards falling costs.

Within the broader crypto panorama, institutional and whale strikes into staking have been rising over the previous months.

Lido stays one of many largest liquid-staking suppliers, and its market share is watched intently by each merchants and protocol researchers.

Indicators Versus Motive

Actions by the Tron boss Solar could possibly be long-term, geared toward yield, or at a broader portfolio shuffle.

There’s something notable within the switch, however it is just a bit to an even bigger image— together with holdings, buying and selling, and tendencies past the broader oblique markets.

Featured picture from Unsplash, chart from TradingView