When you had invested $10,000 in Celestica (TSX:CLS) inventory simply three years in the past, you is likely to be taking a look at a portfolio worth of over 1 / 4 of one million {dollars} at present. The prime Canadian development inventory’s staggering 2,500% surge turns heads whereas leaving many traders questioning if they’ve utterly missed the boat, or if there’s nonetheless extra to Celestica’s marvellous income, earnings, and money stream development story that would drive optimistic returns for years to come back.

Heading into the $35 billion electronics manufacturing providers firm’s third-quarter earnings report on October 27, Celestica could current a compelling case as a prime TSX development inventory to purchase in October for these with a long-term view. The corporate has discovered itself within the excellent place on the excellent time, serving as a essential manufacturing associate for the know-how giants constructing the world’s synthetic intelligence (AI) infrastructure.

What’s fuelling Celestica’s unimaginable development?

Celestica’s latest success is straight tied to the large spending spree by its hyperscale clients — the tech titans increasing their information centres for brand spanking new AI functions. The corporate builds the important high-performance networking tools, like information centre switches, that permit these advanced AI techniques to operate effectively.

The corporate’s rising gross sales are being accompanied by increasing working revenue margins and surging earnings per share. In its second quarter of 2025, Celestica grew income by 21% to $2.9 billion, blowing previous its personal steerage. What’s extra spectacular is that its adjusted earnings per share (EPS), which represents the revenue allotted to every share of inventory, jumped by 54%. This highly effective pattern of earnings rising quicker than income attracts a rerating of a inventory’s valuation multiples increased.

Celestica’s increasing working margin, which hit an organization document of seven.4% in 2025, is spectacular for traders. Consider it this manner: for each $100 in gross sales, the corporate is now pocketing $7.40, extra revenue after overlaying its operational prices than the $4.40 it used to make in 2023. This surge in profitability is basically pushed by its Connectivity & Cloud Options (CCS) phase, which handles the high-demand AI {hardware} and boasts even increased adjusted working margins of 8.3%.

Celestica’s deep moat in a high-tech market

Celestica’s income is often extremely focused on just a few giant clients. One would possibly suppose that Celestica’s reliance on just a few giant clients is a significant threat (and that’s principally true). Nonetheless, the corporate has skillfully turned this focus right into a aggressive benefit. Celestica doesn’t simply assemble off-the-shelf components; it engages in deep, co-design partnerships with its shoppers to develop personalized merchandise. These joint innovation packages create extremely sticky relationships, making it troublesome for opponents to swoop in and steal its enterprise.

This management is clear in its product lineup. Whereas demand for its 400G switches stays very sturdy in 2025, the corporate might see an aggressive ramp-up of its next-generation 800G switches throughout the second half of the 12 months and into 2026. Through the second quarter, volumes for 800G merchandise grew to match the 400G enterprise and are set to speed up additional.

This technological edge retains Celestica inventory on the coronary heart of the AI {hardware} growth.

Can CLS inventory’s momentum proceed?

The corporate lately raised its full-year 2025 monetary outlook, now anticipating 20% income development to $11.6 billion and a shocking 42% improve in adjusted EPS to $5.50 per share. Administration’s optimism is supported by tangible development drivers. The corporate deliberate to start ramping up manufacturing for a next-generation AI compute program with a big hyperscaler buyer throughout the third quarter, a brand new income supply that can lengthen into the subsequent 12 months. Total company margins might develop into double-digit ranges if AI spending retains ramping up over the subsequent two to a few years, driving the inventory doubtlessly increased.

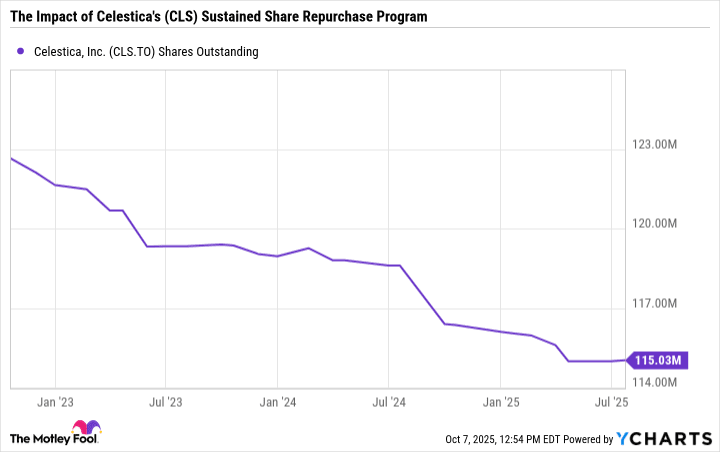

Moreover, Celestica continues to return worth to shareholders via its inventory buyback program, having repurchased roughly 600,000 shares within the second quarter alone. These buybacks scale back the variety of shares excellent, which helps to spice up EPS.

CLS Shares Excellent information by YCharts

Whereas Celestica’s inventory is not low cost by conventional metrics just like the ahead price-to-earnings (P/E) ratio, which towers above 47, CLS inventory’s premium valuation displays its explosive development and strategic place. If the AI infrastructure build-out has years left to run, Celestica inventory might nonetheless outperform the TSX over the subsequent 12 months or two.