Asset Entities shareholders have accredited a merger with Bitcoin asset administration firm Try Enterprises to create a brand new enterprise named Try, Inc.

The objective of the merger is to determine the primary publicly traded asset administration Bitcoin treasury firm. Try, Inc. will likely be publicly traded on the Nasdaq underneath the ticker ASST.

Yesterday’s announcement resulted in a 52% surge in social media advertising and marketing agency Asset Entities’ inventory worth, reflecting robust investor confidence within the new firm’s technique.

Try Inc. plans to lift $1.5B to purchase and maintain Bitcoin as a long-term funding whereas implementing disciplined methods. That is thrilling information for Bitcoin holders as development in company Bitcoin adoption reduces the circulating provide and infrequently pushes costs increased.

The merger can also be anticipated to maximize Bitcoin publicity for shareholders, amplifying long-term returns if $BTC continues its upward pattern.

The rise in institutional Bitcoin accumulation additionally creates a good backdrop for Bitcoin-related initiatives, reminiscent of Bitcoin Hyper ($HYPER).

Asset Entities’ 52% Inventory Surge and What It Means for Bitcoin

Asset Entities shares have been already up 17.8% within the hours earlier than the announcement. However when information of the shareholders’ approval hit the headlines, shares skyrocketed to over 52% throughout after-hours buying and selling.

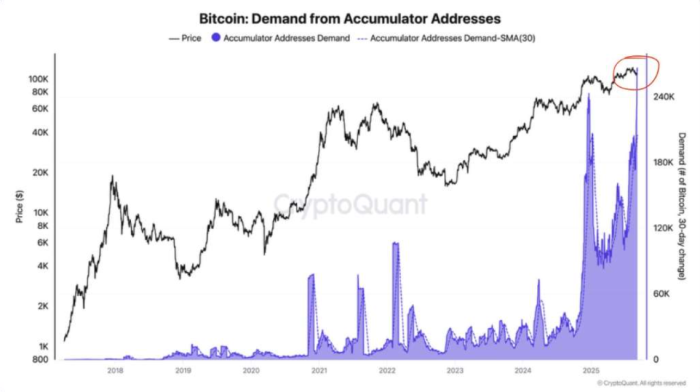

Presently, greater than 180 publicly traded Bitcoin treasury firms maintain $BTC reserves, accounting for roughly 5.1% of the circulating Bitcoin provide.

This company adoption pattern, initiated by Technique (which presently holds 638,460 $BTC), is quickly reworking Bitcoin right into a mainstream institutional asset.

Together with legitimizing Bitcoin’s use, this pattern is reshaping company finance norms and fueling elevated demand, thereby enhancing Bitcoin’s long-term worth appreciation and stability.

What’s The Buzz About This Bitcoin Treasury Deal?

Try Inc’s plan to determine a $1.5 billion Bitcoin treasury has fueled the prevailing bullish market sentiment, driving $BTC costs additional upward.

Retail traders are additionally set to achieve oblique publicity to Bitcoin’s worth and treasury administration by proudly owning shares within the new entity.

To not point out, mergers like this might structurally alter the liquidity and danger profile for retail traders, as they enhance Bitcoin shortage and create new monetary alternatives in public markets.

Why Buyers Are Wanting To Bitcoin Hyper

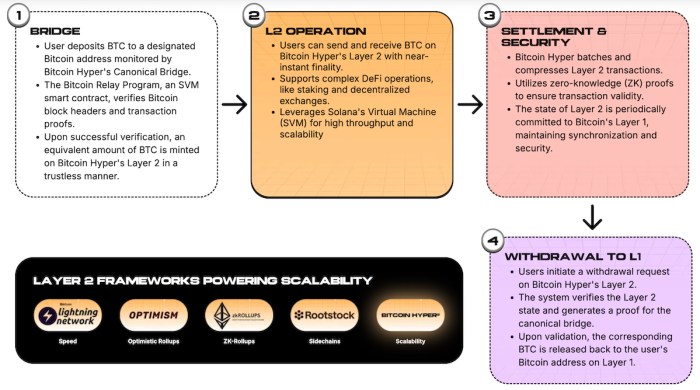

Bitcoin Hyper ($HYPER) is an progressive Layer-2 resolution for Bitcoin, designed to eradicate Bitcoin’s ache factors. And there definitely are just a few of them. Bitcoin is famend for its top-notch safety. However in the case of transaction speeds – by no means thoughts the prices – Bitcoin leaves loads to be desired.

Bitcoin can also be restricted by way of sensible contract execution, leaving DeFi, staking, dApps, and co out of the equation. However that’s the place Bitcoin Hyper steps as much as the plate, with an progressive Layer-2.

Powered by its native token, $HYPER, the Layer-2 integrates a Canonical Bridge that allows you to ship your $BTC to a devoted pockets. As soon as verified, your $BTC will likely be minted on the Hyper Layer-2 as wrapped $BTC.

There, you should use your tokens for immediate funds, DeFi, and dApps.

There, you should use your tokens for immediate funds, DeFi, and dApps.

Maybe better of all, the Layer-2 additionally integrates the Solana Digital Machine. Meaning quicker, cheaper transactions which are extra on par with Solana’s 65K max theoretical transactions per second charge in comparison with Bitcoin’s dismal seven.

In a nutshell, Bitcoin Hyper has loads going for it, and traders are taking be aware. Wish to uncover extra about $HYPER? Our full information to $HYPER’s options and potential explains all of it.

Is $HYPER Set To Soar?

The Bitcoin Hyper presale has already raised $14.8M+ and there aren’t any indicators of it slowing anytime quickly.

Whales have additionally joined in on the motion – final month alone noticed two important whale buys of $161.3K and $100.6K. So, is $HYPER set to soar? It definitely appears prefer it.

We’re not shocked, although. Bitcoin Hyper’s Layer-2 has the potential to be a market game-changer. $HYPER additionally positions itself as a venture the place early traders stand to learn loads.

Discover out tips on how to purchase $HYPER in our step-by-step information.

The Bitcoin Hyper presale is working on a tiered pricing mannequin, with the following worth enhance scheduled for tomorrow. This implies you have got a restricted window to safe your $HYPER tokens on the present discount worth.

Prepared to leap in? Head to the official Bitcoin Hyper presale web site now.

Potential Positive factors for Early Buyers

The merger between Asset Entities and Try Enterprises marks a milestone in Bitcoin’s company adoption, because the newly fashioned firm goals to determine one of many largest publicly traded Bitcoin treasuries.

This not solely validates Bitcoin’s legitimacy as a mainstream institutional asset but in addition units a robust instance for each retail and institutional traders.

Moreover, it has additionally bolstered Bitcoin’s function as a trusted treasury asset, amplifying confidence throughout the broader crypto ecosystem.

Because the ripple impact naturally extends to rising initiatives, now’s the time to leverage this momentum and profit from early alternatives, such because the Bitcoin Hyper presale.

$HYPER presents a superb alternative to change into a part of Bitcoin’s evolving monetary ecosystem and place your self on the forefront of Layer-2 scalability and innovation.

The crypto market is extremely unstable and carries important dangers. All the time conduct your individual analysis earlier than making any funding selections.

Authored by Aaron Walker, NewsBTC – www.newsbtc.com/information/bitcoin-treasury-coming-bitcoin-hyper-smart-investment